Key takeaways:

- Congress must investigate the circumstances that led to the closures of Silicon Valley Bank and Signature Bank of New York.

- Allowing a large, too-big-to-fail institution to buy a smaller, troubled one should be considered as a possible solution to prevent further crisis in the banking sector.

- The $30 billion cash infusion to First Republic is a sign of the banking sector’s resilience and its ability to respond to the economic crisis.

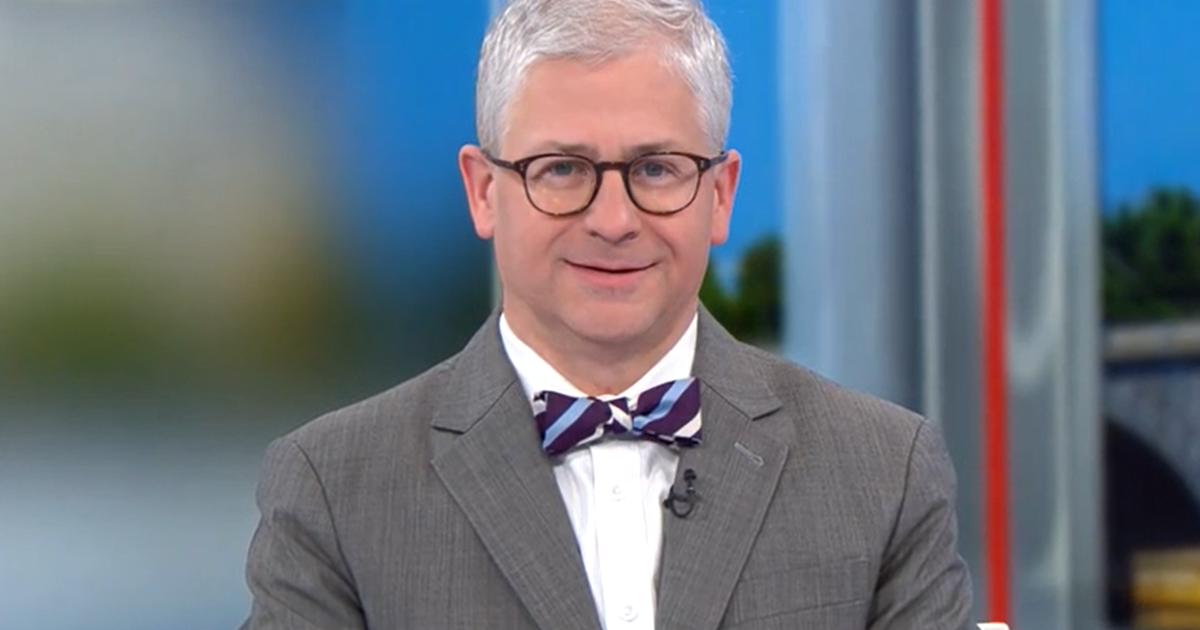

In an interview with “Face the Nation,” Rep. Patrick McHenry, the chair of the House Financial Services Committee, said Congress must explore the circumstances that led to the abrupt closures of Silicon Valley Bank and Signature Bank of New York earlier this month. He believes “all options should be on the table” to prevent further crisis in the banking sector, including allowing a large, too-big-to-fail institution to buy a smaller, troubled one.

McHenry’s comments come after JPMorgan Chase CEO Jamie Dimon reached out to Treasury Secretary Janet Yellen and Federal Reserve Board Chair Jerome Powell on Thursday. A source close to the 48-hour deal to infuse First Republic with $30 billion in cash said it was “the biggest example of a bank that could go down and shouldn’t go down — a first-class bank.”

The San Francisco-based First Republic, the 14th-largest bank in the country, received the cash infusion from 11 rivals, including America’s largest lenders. The deal was seen as a sign of the banking sector’s resilience in the face of the economic crisis caused by the COVID-19 pandemic.

McHenry said Congress must investigate the circumstances that led to the closures of Silicon Valley Bank and Signature Bank of New York, as well as the Biden administration’s response. He also said that allowing a large, too-big-to-fail institution to buy a smaller, troubled one should be considered as a possible solution to prevent further crisis in the banking sector.

The $30 billion cash infusion to First Republic is a sign of the banking sector’s resilience and its ability to respond to the economic crisis. It remains to be seen if Congress will explore the circumstances that led to the closures of Silicon Valley Bank and Signature Bank of New York, and if allowing a large, too-big-to-fail institution to buy a smaller, troubled one will be considered as a possible solution.

Be First to Comment