Key takeaways:

- The Fed has raised its benchmark interest rate to its highest level in 15 years, making mortgages, auto loans, credit card rates and business lending more expensive.

- Powell will have to convince lawmakers that the central bank is capable of bringing down inflation without crashing the US economy.

- Powell’s testimony will provide insight into the Fed’s plans for the future and how it will manage the economy in the months ahead.

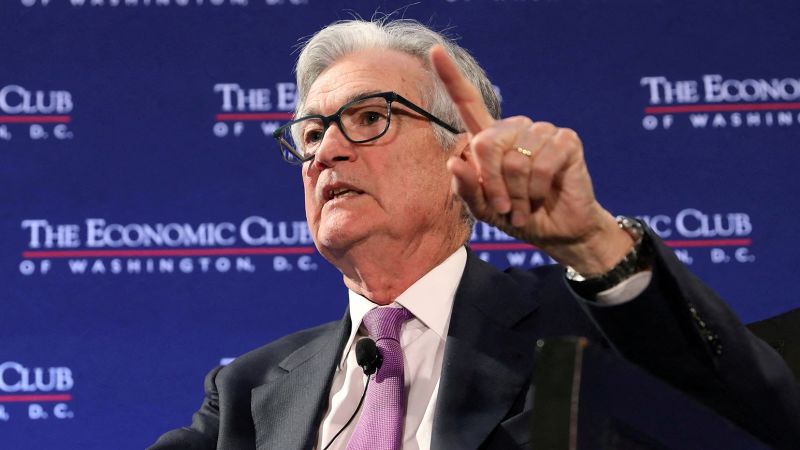

Federal Reserve Chair Jerome Powell is set to testify before Congress on Tuesday, and investors are watching closely for signs of future rate hikes. Powell is likely to warn of the potential consequences of raising the Fed’s key rate above the 5.1% level they had projected in December, if growth and inflation remain elevated.

The Fed has raised its benchmark interest rate at the fastest pace in four decades, to about 4.6%, its highest level in 15 years. This has made mortgages, auto loans, credit card rates and business lending more expensive.

Powell will have some good news to report when he last testified before Congress nine months ago. Signs of the economy’s resilience and stubbornly high inflation have been present since then. Powell will be tasked with convincing lawmakers that the central bank is capable of bringing down inflation without crashing the US economy in its wake.

The Fed’s rate hikes have been a cause of concern for some economists, who worry that the central bank is raising rates too quickly and could cause a recession. However, Fed officials have said that the economy is strong enough to handle the rate hikes.

Powell’s testimony will be closely watched by investors and economists alike. It will provide insight into the Fed’s plans for the future and how it will manage the economy in the months ahead.

Be First to Comment